It’s that time of year again when our WhatsApp groups explode with “Is this a real deal?!” screenshots, trolleys crash in aisles, and someone always ends up buying a 75-inch TV they definitely don’t have space for. Yes, Black Friday is basically South Africa’s unofficial national holiday.

But while we’re all hunting bargains, have you ever wondered: does this annual price-slashing madness actually affect South Africa’s inflation rate? Or is it just a blip that Stats SA politely ignores while sipping coffee? Let’s unpack this in true Mzansi style – with facts, a bit of cheek, and zero doom-and-gloom.

1. Inflation 101: It’s Basically a Braai Price Index

Inflation is just a fancy word for “stuff is getting more expensive on average”. Every month, Stats SA sends out very brave (and very patient) people to check the prices of a fixed “basket” of about 400 everyday goods and services that the average South African household buys.

Think of it as the ultimate braai shopping list:

- Bread, milk, maize meal, chicken, electricity, petrol, rent, cell phone airtime, school fees, haircuts… even beer and cigarettes (yes, really).

They compare this month’s total cost to last month’s. If the basket now costs R10,500 instead of R10,000, headline inflation is running at about 5%. Simple, right? The key word is average. One or two items going on sale doesn’t tank the whole number.

2. Black Friday Hits Mzansi: From American Leftovers to Local Legend

Black Friday started in the USA as “the day after Thanksgiving when retailers finally went into the black (profit) instead of red (loss)”. It landed in South Africa around 2012–2014 when the big boys – Takealot, Makro, Game, Checkers – decided we also deserve to trample each other for discounted air fryers.

Fast-forward to 2025 and it’s massive. We’re talking 30–70% off on TVs, laptops, furniture, clothing, appliances, and even groceries in some cases.

Typical 2024/2025 Black Friday vibes in SA:

- TVs: 40–60% off

- Laptops & phones: 20–40% off

- Furniture: up to 60% off

- Clothing: 50–70% off at Edgars, Mr Price, etc.

- Groceries (yes, really): Checkers Sixty60 and Pick n Pay sometimes do 30–50% on staples

(We’ll give our retailers the benefit of the doubt and assume none of them are doing that dodgy “inflate prices in October, slash them in November” trick we keep reading about overseas. Pinky promise, guys. 😇)

3. So… Do Black Friday Discounts Actually Lower Inflation?

Short answer: Not really (Or am I plotting a twist?). Here’s why:

The official CPI (Consumer Price Index) numbers for November are collected throughout the entire month. Black Friday is literally one long weekend (sometimes stretched into “Black November”). Those crazy discounts are a tiny speck in a whole month of normal pricing.

Stats SA also uses statistical wizardry to “smooth out” temporary sales, seasonal effects, and one-off events. So even if TVs drop 50%, the official “audio-visual equipment” category barely twitches.

But here’s the quirky twist: when December rolls around and everything snaps back to normal price (or quietly creeps even higher), that sudden jump can actually nudge inflation upwards a teeny bit. So in theory, Black Friday might accidentally be mildly inflationary in the next month! Who saw that coming?

4. What About Us Stockpiling Like Doomsday Preppers?

This is the fun part. South Africans go HARD on Black Friday. We buy:

- A year’s supply of toilet paper

- Three toasters “in case one breaks”

- Enough baby formula or dog food to last until 2027

That means December and January spending on those items often drops like a stone. Lower demand: retailers sometimes keep prices stable or even discount again in Jan sales, which can actually help keep inflation a little lower in Q1.

So weirdly, our national bargain-hunting spree might give the Reserve Bank a tiny helping hand in the inflation fight a few months later. You’re welcome, Governor Kganyago. 😎

5. So does Black Friday help or not? The big drumroll…

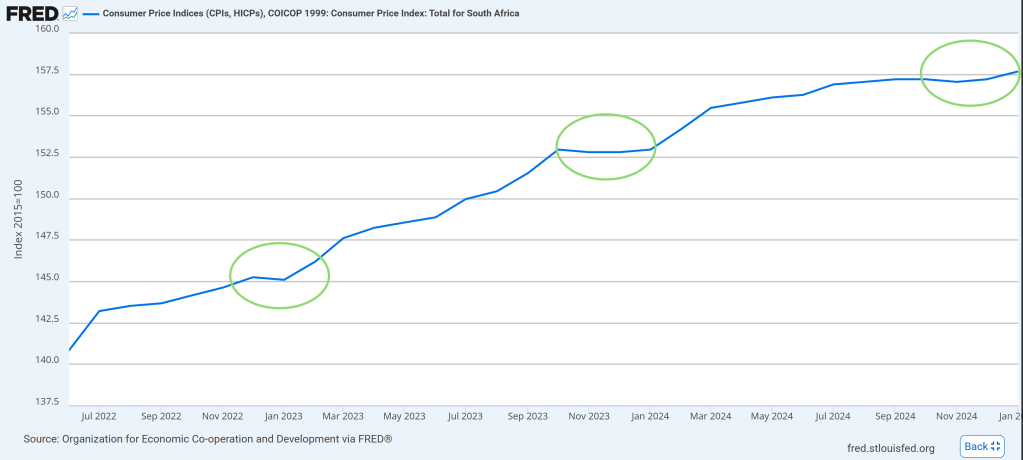

I am not an economist, and yes, this might actually change this article into rocket surgery if I tired to get to the bottom of it. I will leave that to the really smart people. HOWEVER, there is a little blip of a lower gradient on the inflation graph that may suggest Black Friday has a little something to do with alleviating inflation pain over Xmas. Or it may be a plethora of other factors, but for now let’s give credit to the negotiation skills of procurement in large retailers! It’s probably not Santa being generous.

Of course it’s temporary. Come January, we’re all back to paying R400 for two bags of groceries and pretending we don’t notice. But for that brief, beautiful window? Black Friday is out here doing the SARB’s job better than some interest-rate hikes.

6. The Verdict & References

Final quirky conclusion: Black Friday itself barely moves the official inflation needle in November – it’s too short and Stats SA is too clever. BUT the great South African Stockpile of 2025 might actually give us a small deflationary tailwind in early 2026. So in a roundabout way, your insane trolley dash could be doing the economy a solid.

Keep calm and shop responsibly… or don’t. I’m not your financial advisor. 🫶

Now tell me in the comments: What’s the most ridiculous thing you’ve ever bought on Black Friday? I once bought a drone… still in its box in 3 years later. No regrets. 😅

#BlackFriday #Inflation #SouthAfricanEconomy #EconExplained #MzansiRetailTherapy

Image credits: https://fred.stlouisfed.org/series/ZAFCPIALLMINMEI, CardMapr.nl on Unsplash, Tim Mossholder on Unsplash,