As a South African I have heard so many people make a sweeping statement that it’s better to own a property than to rent. ‘You need to pay off your own asset and not someone else’s’. Our parents have indoctrinated this notion into our belief system that we all have just accepted that we must buy our home.

So that is what I did. As soon as I completed university, I bought a two-bedroom flat, and I was paying off my own asset. I soon bought another and a few years later I had a few units that I was letting and someone else was paying off my asset. My parents were so proud!!

I had one friend that always said he would never buy a home. How can we be friends if you cannot understand basic investment fundamentals? You will never build wealth if you rent! Or so I thought, and it took a long time for me to realise that I could not agree more with his unpopular opinion.

Now let me also say that this is not a one size fits all rule and that there are clear exceptions. Some homes can be bought as a fixer-upper and sold at a profit. There are some areas where home values appreciate faster than the norm, but usually by the time you find that suburb the realtors have known about it for a long time and exploited the opportunity so they are hard to find.

Investment or just an asset?

Your home is absolutely an asset. I disagree a little with Robert Kiyosaki (the writer of Rich dad poor dad) about the exact definition of this one, but we feel the same way about owning your home. An asset retains a value that it can be sold for at a later stage. Remember that any asset’s value can depreciate. That is why many people often erroneously say a car is not an asset. It loses value but can still be sold at a value albeit less than you bought it for.

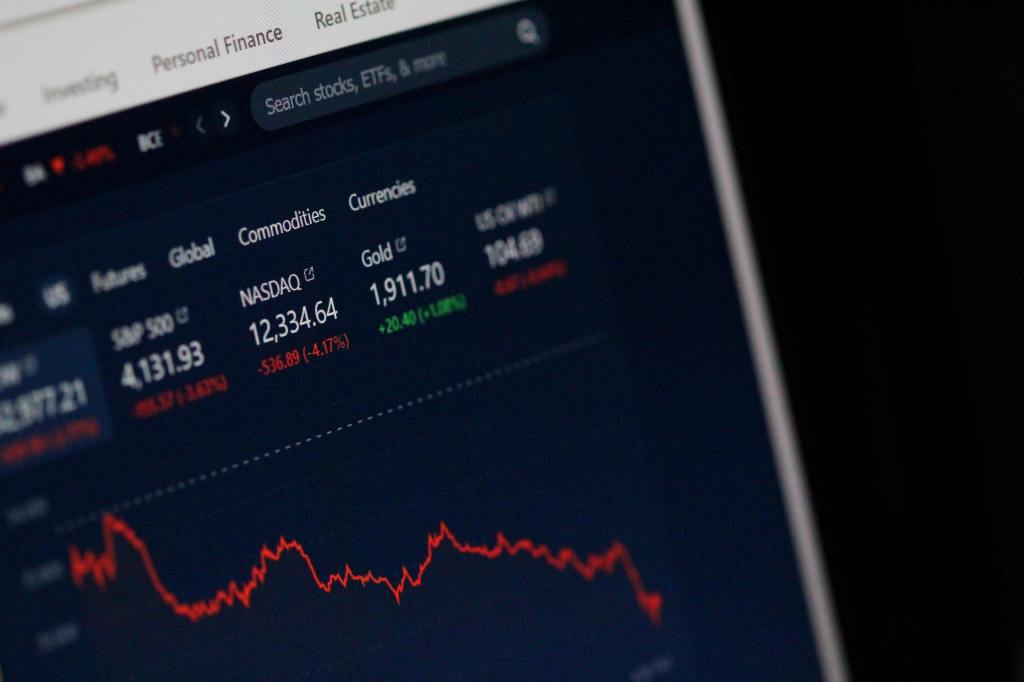

Is a home an investment? This can become a complicated conversation when you consider if you live in it, have a property you let and receive a rental income or buy to improve and sell. Let us remove the last option so you are considering keeping the home for as long as you can. The answer is yes, the home is an investment, but is it a good one or are you destroying wealth? When you have an investment in a stock market that crashes it is still an investment. Is a home the same as a car and it loses value the first time you turn the door key?

The numbers behind the opinion.

The Finance Buff makes a statement that if you let a property and receive an income it is an investment. I would like to argue that since the rental market makes the property owner a price taker and not a price maker very often the rental income is below the loan repayment and other expenses. This means that you will not make a monthly profit or even break even until the home is paid off. That does not consider the risk of the home being vacant or worse, having a tenant that lost their job and cannot pay. A more common occurrence in our current economic climate.

Robert Kiyosaki makes the point in his article Rich Dad Scam #6: Your House is an Asset that a home that you live in takes money out of your pocket (maintenance, taxes etc.) and that in the current economy its more likely that your home is a liability.

Erwin Rode, MD for Rode &Associates tells us that the house prices do increase so you will most likely sell it for more than you bought it. However, when you compare the house price growth to the inflation rate, they are depreciating in real terms. In fact, for most of the last decade residential house price growth remained below inflation.

This only considers local factors. We are not in a bubble but rather a country whose currency value is impacted more by international markets than our own. So, when those markets crash our little bubble bursts! Let’s just consider the Rand-Dollar exchange rate over the last 20 years, 20 years being a pretty standard bond repayment term.

The Rand depreciated from Dec 2000 to 2020 from R7.63 to R15.15 to the Dollar. We know the Rand hit R19 to the Dollar in 2020 due COVID 19 so who knows where it will go next?

To simplify, let us say that you bought a home for one million Rand 20 years ago and the Rand lost 50% of its value by the time you paid your bond. You also slowly lost out on your property valuation growth versus inflation for 20 years so in real terms your home is worth less than what you bought it for. Simplifying again, let’s say you are one of the fortunate few and you broke even so we can keep the one million rand real property value. Factoring in the Rand-Dollar depreciation your home is now worth R500 000.

If you took a home loan at 9% interest over 20 years your total repayment is just over R2.15 million. This means in a global market you paid more than double for a home that is now worth half of its original value. And we have not considered rates and tax, maintenance or any other expenses.

The early bird catches the worm, what about the early worm that got caught?

In doing my research for this article I came across many articles and opinions saying that a home is always an investment and the time to buy is now. It may be a good time to buy since it is a buyers’ market (if you are still considering buying after reading this). Interest rates are down, people have lost their income due to the pandemic so some homeowners had to downscale or release some assets and there is a general over supply of property as developers build on every piece of land they can lay their hands on.

Well that is great for new first-time homeowners but remember that the people that bought homes, the early worms are the ones that got caught off guard. There is no guarantee that will not happen to you so while it is a buyers’ market, should you be buying at all?

The solution for people like me

The rental market is very good in most of South Africa. Cape Town may have a less attractive rental market due to tourists purchasing holiday homes pushing up the prices. In Gauteng you can rent for less than what a monthly bond repayment would be, you don’t have to pay maintenance, levies, rates and tax etc. so the same home becomes more affordable.

What this means is that you can live in the home that you love and if you are disciplined, you can invest the monthly savings to create the wealth you would have otherwise lost. The rental market would change if everyone took my advice and sold all their rental properties, for now I am sticking to this opinion.

So, in conclusion: parents, stop lying to your kids about property. Let them read this article and books. Let them do their homework and figure out what it is that they want to do with their money and how they will grow their wealth.

Photo Credits: Mathew Schwartz, Anne NygårdUnsplash,